Recently, Consumer Reports published an article, “What you don’t know about homeowners insurance could cost you.” The article serves as an important reminder to review your policy before disaster strikes. Do not be caught overpaying on homeowners insurance while lacking the protection you expect or truly need.

“Purchasing a home is an overwhelming task, with so many details so when it comes time to get homeowners insurance, it is common to select inadequate coverage without knowing it,” says Dustyn Shroff, Vice President of GreatFlorida Insurance.

Homeowners insurance serves to protect you and your family from the anxiety of a worst-case scenario. Of course, if a catastrophe doesn’t occur, you probably don’t think much about it. Consumer Reports unveils some surprises to consider when selecting and reviewing your homeowners insurance. We examine some of them below.

Paying too much

“Homeowners insurance requires a careful assessment of your risks and coverage needs. We recommend working with an independent agent who can compare premiums and isn’t beholden to just one company,” says Consumer Reports.

When selecting homeowners insurance, go with a company that offers flexibility in pricing. Independent insurance agents like the ones at GreatFlorida Insurance, comparison shop different insurance companies to find customers the best service at the best price. Captive agents at a company such as Allstate are restricted to only offer their company’s insurance products leaving you no other options for price. Switching insurers on your current policy could save you thousands.

Not enough coverage

A standard homeowners insurance policy covers the structure and outbuildings, contents of the home, liability if you are legally responsible for damage to others, medical payments if someone is injured on your property and additional living expenses if your home is uninhabitable due to a covered loss. Any additional coverage, you most likely will need to add.

Also, the amount of homeowners insurance required, is partially determined on the value of your home. Renovations will drive up the price of your home and your current insurance might not be sufficient to replace your new items, such as a new marble counter top if it is damaged.

However, renovations do not always mean an increase. Some upgrades such as window and door replacement or the installation of a security system can make you eligible for lower premiums or discounts.

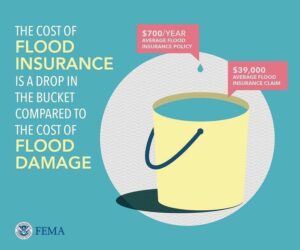

Consider Flood Insurance

“It only takes inches of water in your home to cause thousands of dollars’ worth of damage,” reminds Buck with GreatFlorida Insurance. The Federal Emergency Management Agency (FEMA) declares flooding as the most common disaster in the U.S. With the storm frequency in Florida, every homeowner should have flood insurance. However, it is not included in homeowners insurance.

Nevertheless, flooding is not only caused by storms but overflowing tubs, toilets and sinks. Flood insurance is available to protect homes through the National Flood Insurance Program (NFIP). Your insurance agent can sell you a flood insurance policy through the NFIP, which is administered by the U.S. Government.

Contact GreatFlorida Insurance if you want to sign up for Flood insurance or review your homeowners insurance policy today.