Frustrated Insurance Commissioner Kevin McCarty recently threw out the idea, “Let’s fix it or flush it. We have done everything to fix PIP you could have possibly have done.” McCarty believes ending Florida’s Personal Injury Protection, PIP requirement would cut off the flow of money feeding PIP fraud.

“Personal Injury Protection, also referred to as no-fault auto insurance is to blame for widespread insurance fraud across Florida,” said Dustyn Shroff, Vice President of GreatFlorida Insurance. “Fraud schemes are so bad they have caused some insurance companies to pull out of offering auto insurance in Florida.”

Examples of how far reaching the fraud schemes go are evidence in recent arrests and lawsuits.

- A Florida chiropractor was recently arrested for felony fraud charges for running a $1.5 million insurance fraud scheme.

- The A&E show American Takedown featured the case, “Operation Cold Call” which uncovered a network of attorneys, doctors and clinic employees who were engaged in recruiting, paying and treating phony patients for treatments that did not exist for staged car accidents.

- The Sun Sentinel reported a story of a criminal ring involving a bank, medical clinic owners, patient recruiters and sham accident victims. The ring purportedly conned Allstate out of $10 million.

PIP requirements were implemented as part of auto insurance coverage so car accident victims could receive quick payments for medical treatments required without having to wait for a determination on the responsibility of an accident. It was also intended to free up the courts from small claims cases.

Buck with GreatFlorida Insurance informs, “Policyholders recover expenses for car accident injuries from their own insurance company regardless who is at fault for the accident.” Drivers are required to purchase PIP to cover medical expenses and those of passengers. Florida PIP provides up to $10,000 in coverage for medical expenses.

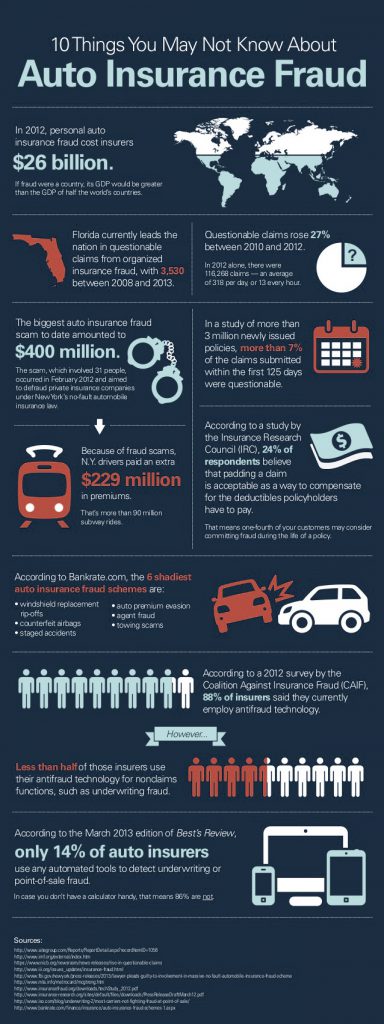

Unfortunately, the unintended consequences of no-fault auto insurance have been rampant fraud. Florida is considered the car insurance fraud capital. Staged accidents or dishonest medical professionals file false or inflated claims to exploit the system. According to the Insurance Information Institute, fraud costs the Florida PIP insurance system one billion dollars a year.

GreatFlorida Insurance has experienced professionals located throughout the State to make sure you get the right car insurance. Contact us today.