An appeal of Florida’s current No-Fault/Personal Injury Protection(PIP) system for auto insurance, is gaining momentum this legislative session. The Florida House voted 88-15 to repeal the State’s PIP system.

“For some time, Florida lawmakers have argued over eliminating PIP and replacing it with a fault-based system,” says Dustyn Shroff, Vice President of GreatFlorida Insurance, Florida’s largest independent auto insurance company.

Under House Bill (HB19) drivers would be required to purchase bodily-injury liability coverage at $25,000 per person and $50,000 per accident. According to a 2016 actuarial study commissioned by the Florida Office of Insurance Regulation, drivers could save up to $81 per vehicle.

“While the House and Senate both look to eliminate No-Fault auto insurance coverage the version of their proposed bills are quite different,” says Buck with GreatFlorida Insurance, Florida’s top independent auto insurance company.

The Senate proposal (SB 150) would replace the PIP system in 2019 requiring all drivers to carry bodily injury coverage of $20,000 per person and $40,000 per accident as well as mandatory medical payment coverage(MedPay), of $5,000. Coverage would increase to $30,000 per person and $60,000 per accident after three years. Under the Senate bill, Florida drivers could see and increase or decrease depending on the area they live. Opponents of the Senate bill are concerned about the cost increase to drivers. They also believe requiring mandatory medical payments is unnecessary for those with current health insurance plans.

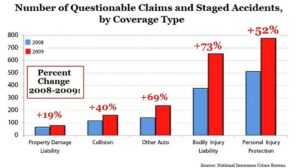

No-Fault auto insurance was designed to reduce litigation across the state by creating money for anyone injured in a crash. Unfortunately, it created a flood of lawsuits which lawmakers hope to eradicate with the repeal. Since Florida’s adoption of a No-Fault system, fraudulent claims have cost the state a tremendous amount of money. In a report from The Division of Insurance Fraud, they found a 275% increase in fraud auto claims between 2007-2012. In 2012, duplicitous auto claims cost the state over $1 billion, driving the cost of insurance premiums higher for Florida drivers.