With Hurricane Irma’s path is still uncertain, preparations across Florida are underway. State officials are warning residents to prepare for the worst.

“Seeing the recent destruction caused by Hurricane Harvey, Floridians are taking this storm threat seriously, says Dustyn Shroff, Vice President of GreatFlorida Insurance, Florida’s largest independent homeowners insurance agency.

What do you need?

For starters, assemble an emergency kit. Your emergency kit should contain at least the essentials. Consider making one to keep in your car and one at home. The Federal Emergency Management Agency, FEMA recommends:

- Water-rule of thumb is one gallon per person per day for 3 days

- Food-non-perishable items for at least 3 days for each person

- A battery powered or hand crank radio

- Flashlight with extra batteries

- First aid kit

- Multi-purpose tool, such as Swiss Army knife

- Personal hygiene items

- Plastic bag for trash

- Map of your area

- Medications

- A copy of important documents- birth certificates, passport, insurance policies, etc.

- Blanket

- Emergency contact information

- Cell phone and charger

Try to always keep at least half a tank of gas in your car in case you need to hit the road in hurry. Likewise, have some cash on hand or in your emergency kit. Also, know if you live in an evacuation area, get familiar with the evacuation routes.

Handling Insurance

Time is an asset. “As part of your preparations take a photo inventory, it is the simplest way to document your possessions,” suggests Buck with GreatFlorida Insurance. Snap pictures of your closets and drawers to show ownership of clothes and shoes. Take clear photos of jewelry, electronics, power tools, china and other valuables you might own. Date the photos and if possible list the purchase price. If anything is destroyed, this step is helpful when dealing with replacement costs regarding homeowners insurance and renters insurance.

Most homeowners insurance cover hurricane wind damage, but not flood damage. Flood insurance is provided by the National Flood Insurance Program. According to the National Oceanic and Atmospheric Administration, (NOAA), “Flooding is the most frequent and severe weather threat.” With 90 percent of natural disasters in the U.S. being flood related. Floods are also the costliest natural disaster.

Federal disaster assistance is only offered when the president declares a major disaster, which happens half of the time. The Insurance Information Institute, III reports that most insurers will not allow changes to be made to insurance policies once a hurricane watch or warning is issued by the National Hurricane Center.

What to expect?

The National Hurricane Center is reporting that Irma is currently a category 5 hurricane and “extremely dangerous.” Hurricane Wilma (category 5), hit Florida in 2005 leaving almost 4 million people statewide without electricity for several days. Widespread flooding and property damage is common during a severe storm preventing access to clean water and shutting down businesses.

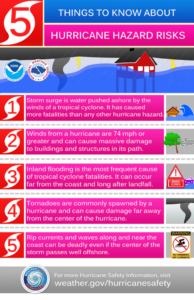

Hurricanes cause storm surges and battering waves, producing an abnormal rise of water that can travel several miles inland. There is also flooding from heavy rains, along with wind and tornadoes.

Insurance is designed to help people rebuild their lives. GreatFlorida Insurance can help protect your home with a Florida flood insurance policy provided by the National Flood Insurance Program. We also offer homeowners insurance and renters insurance.